Consumer scams, identity theft and fraud have boomed during the COVID-19 pandemic prompting superannuation funds to bolster fraud prevention strategy. Upgrading from insecure pins, challenge questions and two-step code verifications is a critical security measure in the fraud prevention framework to protect member accounts from a multitude of current and imminent threats.

Read MoreOngoing merger and business transformation activity in superannuation is driving a staggering rate of change and has giving rise to the most interesting transition work QMV has ever faced.

Read MoreHeightened merger, successor fund transfer and digital transformation activity in superannuation has seen QMV reach the 500 milestone in transition capability. To mark this achievement, we have interviewed a mix of our most experienced transition experts on their personal approach, important traps to be aware of and of course the secret sauce!

Read MoreJane McKinnon has worked with an impressive portfolio of local and global financial services institutions. She holds a Masters in Technology and a Bachelor of Business, and is highly sought for complex transitions and successor fund transfers. Jane has exceptional advisory and relationship management capability.

Read MoreKenjoe Bu is rising fast as a highly sought consultant to Australia’s largest financial institutions. His reputation is built on advanced reasoning and critical thinking with a fresh and entrepreneurial perspective. Kenjoe’s uncommon attention to detail and industrious output combined with his next generation approach is very powerful.

Read MoreQMV is delighted to announce the appointment of Joanne Schembri as chief operating officer and Wendy Colaço as general manager, consulting, effective on 1 April, 2021.

Read MoreSunil is a highly commercial and strategic information technology leader with a strong track-record of delivery in operational excellence, digital technology, API/integrations and systems architecture. He offers a unique combination of deep technical expertise and strong leadership with extensive systems and projects exposure across large complex organisations, including mergers, organisational change and multi-cultural environments.

Read MoreInvestigate data quality management platform begins transforming customer and organisation data quality on day-one, enabling financial institutions in their pursuit of data-driven business growth.

Read MoreFor many super funds, combining the best elements of two or more funds is an attractive venture, and in some cases, an inevitable one, with evidence and industry pressure behind it. APRA’s heatmaps still show 18 chronically underperforming super funds, and analysis from Super Consumers Australia estimates that mergers are leaving the average member $15,000 better off in retirement, primarily from fee-savings.

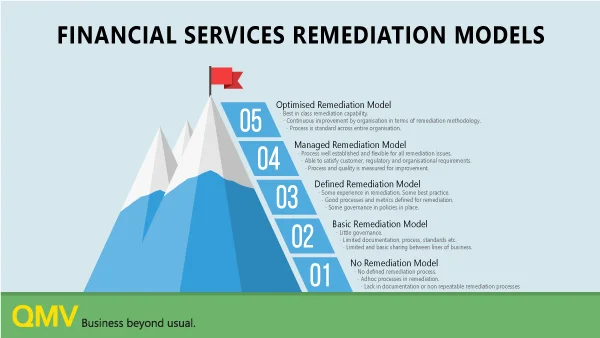

Read MoreThe ability to identify, scope and remediate customer account errors has become a key regulatory item in financial services. These issues can result in breaches and are thus “non-negotiable” with regulators.

Depending on the scale of remediation events, personnel and funding tends to swell and subside. The deeper you look, the more people involved, the more money you throw at it, the more errors you will find.

Read MoreOn 17 February 2021, the Government introduced and read a first time Treasury Laws Amendment (Your Future, Your Super) Bill 2021 (Bill). The Bill was then referred to the Senate Economics Legislation Committee with a report due on 22 April 2021.

Read MoreCustomers expect financial institutions to correctly calculate their financial position and to know exactly who they are. No one wants to be at a loss, especially when it is someone else’s fault. A miscalculation, an administrative mistake, lack of insurance coverage, or other errors, can cause customers to feel wronged, robbed, not cared about or even marginalised.

Read MoreMost executives and most CEOs recognise that data is their most valuable asset, yet a very few actually understand and invest in it. Often no one actually knows who's accountable for it because data often isn't a business unit. Data is needed and held by every part of the business.

Read MoreKirsty began her career in financial services in 2004 and is a trusted leader in compliance and legislative change. Kirsty is also particularly sought for data analysis and holds extensive practical experience in operations, process review, process re-engineering, implementation projects and industry related platforms

Read MoreThe Financial Sector Reform (Hayne Royal Commission Response) Bill 2020 introduced into Parliament departs significantly from the draft legislation as it relates to advice fees in superannuation – this is likely the reason for the delayed introduction and separation from the Hayne Royal Commission Response Bill.

Read MoreBeginning his career in financial services in 2003, Yunus has extensive experience in superannuation and finance transition projects. He is known for his ability to improve processes, requirements elicitation, overseeing technical development and strategic planning.

Read MoreThe Hayne Royal Commission raised a question mark over the quality of customer data held by financial institutions and emphasised that action after the fact via costly data remediation events was not good enough. In a post royal commission world, it is important to know why customer data is so prone to error.

Read MoreBeginning her career in financial services in 2006, Jessica specialises in legislative change, compliance, business analysis and operations. Jessica is highly sought for her advanced technical writing and detailed understanding of the regulatory environment. Her relationship and stakeholder management across all levels is exceptional.

Read More