The Prudential Standard CPS 230 sets out stringent requirements for operational risk management in the superannuation industry. By implementing a robust framework and adhering to these requirements, APRA-regulated entities can effectively manage operational risks, maintain the continuity of critical operations, and enhance their resilience to disruptions. This, in turn, contributes to the stability and integrity of the superannuation industry, promoting trust and confidence from customers, stakeholders, and regulators alike

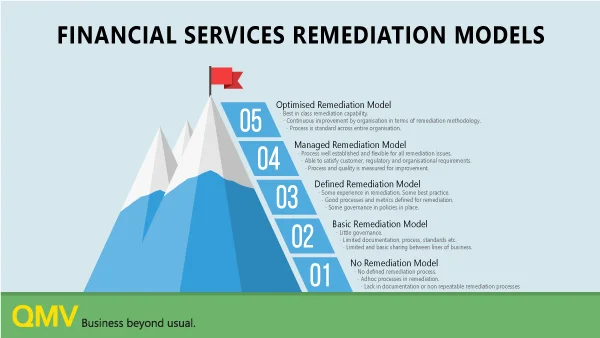

Read MoreData remediation activities in financial services will never cease. The best that can be achieved is significantly reducing the frequency and scope of remediations over time. Remediation does not always indicate a negative financial impact to a customer, but it does indicate a negative financial impact to the organisation.

Read MoreLegislative and regulatory reform has had and will continue to have a significant impact on the superannuation industry. Fund Trustees are faced with the challenge of developing and implementing cost-effective solutions to meet their obligations, often within a condensed timeframe. Therefore, we have outlined six steps in this article that will provide you with the structure and help with successful implementation.

Read MoreThere has never been more reliance and importance on data to provide administration of consumer products effectively and efficiently. The Optus data breach is a significant and public example of data may be used for fraudulent purposes, however, there is an ongoing risk that must be mitigated to ensure that, regardless of scale or publicity, consumer interests are protected as much as possible.

Read MoreOn 27 September 2022 ASIC released Regulatory Guide 277 Consumer Remediation (RG 277) which is intended to supersede the existing guidance in Regulatory Guide 256 Client review and remediation conducted by advice licensees (RG 256). RG 277 is a significant expansion of ASIC’s remediation guidance and now applies to all Australian Financial Services (AFS) and Australian Credit licensees, including superannuation trustees.

It is important to note the guidance within RG 277 applies to all remediation activity from 27 September 2022; however licensees may still utilise RG 256 for any remediation programs already underway at this date.

Read MoreThe quality of data is imperative to strategic decision making, agility, productivity, and survival and qrganisations are beginning to realise that the consequences and risks of making incorrect decisions is now far greater and getting to the point where data is accurate and reliable to derive a "correct” single view of the customer will take commitment, effort, and investment from the financial institutions.

Read MoreAs the industry moves away from ad-hoc or project-based optimisations to more holistic and integrated digital capability, the fund needs ‘mastermind’ thinkers on the transformation program ideally with the trifecta of technology, data and superannuation pedigree.

Read MoreInvestigate data quality management platform begins transforming customer and organisation data quality on day-one, enabling financial institutions in their pursuit of data-driven business growth.

Read MoreThe ability to identify, scope and remediate customer account errors has become a key regulatory item in financial services. These issues can result in breaches and are thus “non-negotiable” with regulators.

Depending on the scale of remediation events, personnel and funding tends to swell and subside. The deeper you look, the more people involved, the more money you throw at it, the more errors you will find.

Read MoreThe Hayne Royal Commission raised a question mark over the quality of customer data held by financial institutions and emphasised that action after the fact via costly data remediation events was not good enough. In a post royal commission world, it is important to know why customer data is so prone to error.

Read MoreAt QMV, we believe that robust data quality management practices not only increase member engagement but also help solidify members’ trust in the company. Recognising a growing demand for more control and customisation around reporting, QMV are very pleased to present the latest version of Investigate featuring some significant enhancements that reaffirms our commitment to meeting our customer’s needs for superior data quality management.

Read MoreThe Hayne Royal Commission rightfully and very publicly raised a question mark over the quality of customer data held by financial institutions. It also highlighted that data remediation – the cleansing, organisation and migrating of data – after costly and often lengthy investigation, warrants greater focus.

Read MoreMany data remediation programs are only started after an issue being brought to light by a customer or group of customers: often upon investigation, this gives rise to a slew of other issues that may have been impacting thousands of customers across several years.

Read MoreQMV has moved into new Sydney offices situated on Clarence Street. Our permanent base in Sydney is fast approaching twelve months and we sincerely thank QMV's valued clients and friends for their backing.

Read More