Investigate data quality management platform begins transforming customer and organisation data quality on day-one, enabling financial institutions in their pursuit of data-driven business growth.

Read MoreFor many super funds, combining the best elements of two or more funds is an attractive venture, and in some cases, an inevitable one, with evidence and industry pressure behind it. APRA’s heatmaps still show 18 chronically underperforming super funds, and analysis from Super Consumers Australia estimates that mergers are leaving the average member $15,000 better off in retirement, primarily from fee-savings.

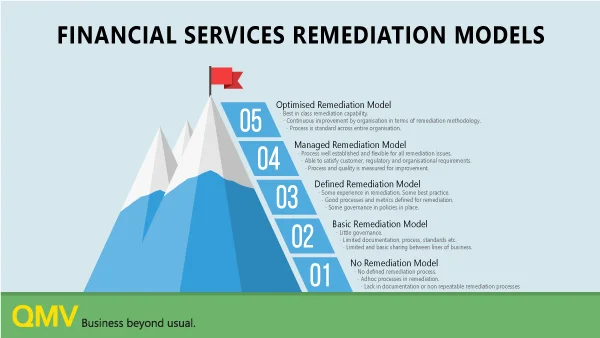

Read MoreThe ability to identify, scope and remediate customer account errors has become a key regulatory item in financial services. These issues can result in breaches and are thus “non-negotiable” with regulators.

Depending on the scale of remediation events, personnel and funding tends to swell and subside. The deeper you look, the more people involved, the more money you throw at it, the more errors you will find.

Read MoreOn 17 February 2021, the Government introduced and read a first time Treasury Laws Amendment (Your Future, Your Super) Bill 2021 (Bill). The Bill was then referred to the Senate Economics Legislation Committee with a report due on 22 April 2021.

Read MoreCustomers expect financial institutions to correctly calculate their financial position and to know exactly who they are. No one wants to be at a loss, especially when it is someone else’s fault. A miscalculation, an administrative mistake, lack of insurance coverage, or other errors, can cause customers to feel wronged, robbed, not cared about or even marginalised.

Read MoreThe Financial Sector Reform (Hayne Royal Commission Response) Bill 2020 introduced into Parliament departs significantly from the draft legislation as it relates to advice fees in superannuation – this is likely the reason for the delayed introduction and separation from the Hayne Royal Commission Response Bill.

Read MoreThe Hayne Royal Commission raised a question mark over the quality of customer data held by financial institutions and emphasised that action after the fact via costly data remediation events was not good enough. In a post royal commission world, it is important to know why customer data is so prone to error.

Read MoreIt is no longer solely the domain of lawyers and judges to interpret the regulatory obligations placed on superannuation funds. It is an increasingly important skill for senior executives, risk, compliance, and even project and IT professionals.

Read MoreWe've put together a brief summary of the measures in the Commonwealth Budget directly affecting superannuation trustees. While there is very little detail on some measures at this stage - it is enough to start thinking & planning!

Read MoreMillions of employees have had salaries and working hours reduced or stopped suddenly due to changes in employment conditions. According to the Budget Overview the Government's JobKeeper payments have supported over 3.8 million workers with the payment of $60 billion in wages.

Read MoreIt is no longer solely the domain of lawyers and judges to interpret the regulatory obligations placed on superannuation funds. It is an increasingly important skill for senior executives, risk, compliance, and even project and IT professionals.

Read MoreOne of the most important components of the due diligence process in superannuation fund mergers are cost projections and agreeing on who’s members are paying for what. There are many risks involved in mergers, but equally there are opportunity costs and risks associated with not doing it

Read MoreEven though reputable third-party providers have data governance frameworks and performance metrics in place, it is important to recognise inherent bias and that data quality governance is not often their core capability. Data quality must be independently and routinely monitored and validated. If access to the data can be obtained, an independent audit can often uncover widespread error for which regulatory breach and costly remediation is a legitimate risk.

Read MoreMany promising superannuation fund mergers over the last decade have failed to eventuate and unfortunately there is little to no research to help us understand why. The question is, why are merger talks prone to collapse especially after the many efforts, expectations and money invested in due diligence, even when benefits to members, employees and the fund seem to be clear?

Read MoreThe question, “Should my fund continue to exist?” if asked three months from today, may produce different answers to the same question if asked earlier in 2020. Smaller funds with members concentrated in vulnerable industries are taking most of the heat around viability during the coronavirus crisis, but cracks are showing up across many funds.

Read MoreTo better support Investigate clients with coronavirus related measures affecting superannuation administration, QMV has released a data assurance content pack dedicated to staying on top of the Coronavirus Economic Response Package.

Read MoreMillions of employees have or will have salaries and working hours reduced or stopped suddenly due to changes in employment conditions. Current estimates indicate that the government’s proposed JobKeeper payment will help pay the wages of 6.7 million workers (source ABC).

Read MoreSix weeks ago, superannuation fund executives knew exactly what their priorities were. Today, protecting the pride while re-imagining the future is a dual task requiring serious intellectual horsepower.

Read MoreContact centre overflow at superannuation funds and third-party administrators has relied upon incredible ingenuity and innovation to manage extreme demand amid the COVID-19 crisis. Current inbound member enquiry is consistently greater than double the norm with major spikes observed tripling and quadrupling enquiry rates.

Read More