In the last decade, the arrival and development of the ‘cloud’ has had a profound impact on the financial services sector, both in Australia and globally. I’m not talking about the cloud Grampa Simpson is yelling at but referring to the term ‘cloud computing’.

Read MoreContact centres are a hot topic across financial services as institutions look to dominate the customer experience race. The drivers come as a result of higher customer expectations, competitive advantage and the need to rebuild trust post royal commission.

Read MoreTrustees need to ‘start their engines’ now to make sure they will be compliant with the design and distribution obligations that will come into effect on 6 April 2021. A project plan needs to be developed now that incorporates product and product governance audits. And that’s before the real work begins!

Read MoreEstablished life insurers currently face the biggest challenge of their reign keeping pace with today’s rate of technological change. Increasingly, better informed customer bases combined with more data than ever before, legacy systems and heightened regulatory scrutiny make transitioning to more innovative, value-driven systems highly challenging.

Read MoreQMV is pleased to release a data assurance content pack dedicated to helping trustees to monitor compliance with the Putting Members’ Interest First reforms. This pack complements existing definitions and rules content available across Investigate including the recent Protecting Your Super data assurance content pack.

Read MoreTrustees of Australian Prudential Regulation Authority (APRA) and self-managed superannuation funds alike should pay close attention to the upcoming case of McVeigh v REST, and the possibilities of either setting a precedent requiring consideration of climate change as a material investment risk or highlighting the need for more specific climate change risk focused regulation.

Read MoreNow is the time for trustees to carry out a holistic review of the processes and controls that govern the product life cycle. The design and distribution obligations that will come into effect on 6 April 2021 complement ASIC’s product intervention powers and ASIC will consult with the industry about them later this year.

Read MoreQMV is proud to exhibit at ASFA 2019 Australia's flagship event for superannuation professionals and associated service providers. We collaborated with Tonic Alchemy to develop a range 100% natural tonics with super healthy properties to help you get through the three days with a kick! Visit QMV at stand 24 and take a shot or two. You might need it!!

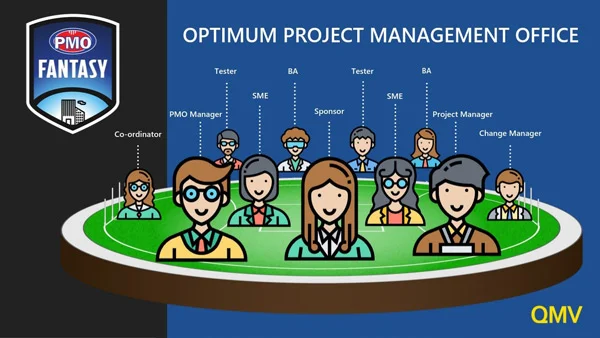

Read MoreSometimes a rag-tag bunch of misfits that have been thrown together join forces and deliver a program of work. When it happens, it can be magical but it’s a rare thing.

You don’t always get to pick and choose. Your strike team might be assembled but you still need a command crew for the shuttle. Here we look at some of the traits you, as a PMO manager should be seeking out to ensure you build a delivery team positioned for success.

Read MoreThe digital age of customer information opens vast opportunities for financial institutions from providing tailored solutions, omnichannel experience and innovative avenues to communicate with customers.

Read MoreQMV has been announced winner of Super Review’s inaugural Consultancy of the Year for Tender and Other Services award, beating fellow finalists Deloitte and Rice Warner. The top performing consultancies were determined based on the results of a Super Review survey that ran throughout June this year as reported by journalist Hannah Wooton.

Read MoreTesting of fintech products and platforms is increasingly a mix of human and automated testing thanks to advancements in technology, machine learning and artificial intelligence. The movement away from manual work can allow financial services organisations to boost product development, improve efficiencies, enhance quality and mitigate risk.

Read MoreAustralia’s superannuation guarantee policy is popular, economically prudent, and coming under increasing political scrutiny. It has been very effective in extending coverage of the superannuation system beyond the public sector and senior management of large companies to most working Australians.

Read MoreQMV is pleased to release a data compliance assurance content pack dedicated to helping funds adhere to the Protecting Your Super reforms. This pack complements existing definitions and rules content available across QMV’s data quality management platform, Investigate.

Read MoreThe Hayne Royal Commission rightfully and very publicly raised a question mark over the quality of customer data held by financial institutions. It also highlighted that data remediation – the cleansing, organisation and migrating of data – after costly and often lengthy investigation, warrants greater focus.

Read MoreQMV is privileged to be nominated in Super Review’s inaugural Superannuation Consultancy of the Year alongside Deloitte and Rice Warner. The winner will be announced at the Super Fund of the Year Awards on 15 August 2019.

Read MoreData remediation activities in financial services will never cease. The best that can be achieved is significantly reducing the frequency and scope of remediations over time. This paper is a brief discussion of the triggers, execution and controls associated with data remediation events and can be applied to superannuation, wealth management, banking and insurance.

Read MoreMany data remediation programs are only started after an issue being brought to light by a customer or group of customers: often upon investigation, this gives rise to a slew of other issues that may have been impacting thousands of customers across several years.

Read More