Customers expect financial institutions to correctly calculate their financial position and to know exactly who they are. No one wants to be at a loss, especially when it is someone else’s fault. A miscalculation, an administrative mistake, lack of insurance coverage, or other errors, can cause customers to feel wronged, robbed, not cared about or even marginalised.

Read MoreThe Hayne Royal Commission raised a question mark over the quality of customer data held by financial institutions and emphasised that action after the fact via costly data remediation events was not good enough. In a post royal commission world, it is important to know why customer data is so prone to error.

Read MoreEven though reputable third-party providers have data governance frameworks and performance metrics in place, it is important to recognise inherent bias and that data quality governance is not often their core capability. Data quality must be independently and routinely monitored and validated. If access to the data can be obtained, an independent audit can often uncover widespread error for which regulatory breach and costly remediation is a legitimate risk.

Read MoreIn the last decade, the arrival and development of the ‘cloud’ has had a profound impact on the financial services sector, both in Australia and globally. I’m not talking about the cloud Grampa Simpson is yelling at but referring to the term ‘cloud computing’.

Read MoreContact centres are a hot topic across financial services as institutions look to dominate the customer experience race. The drivers come as a result of higher customer expectations, competitive advantage and the need to rebuild trust post royal commission.

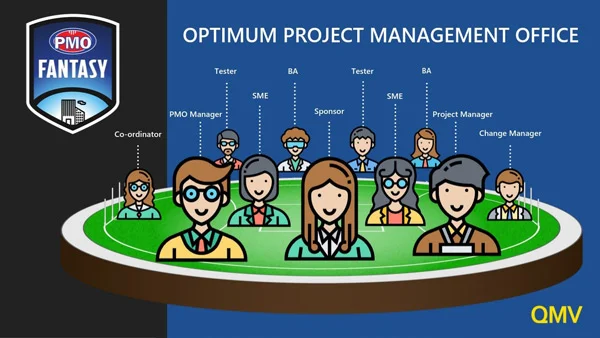

Read MoreSometimes a rag-tag bunch of misfits that have been thrown together join forces and deliver a program of work. When it happens, it can be magical but it’s a rare thing.

You don’t always get to pick and choose. Your strike team might be assembled but you still need a command crew for the shuttle. Here we look at some of the traits you, as a PMO manager should be seeking out to ensure you build a delivery team positioned for success.

Read MoreThe digital age of customer information opens vast opportunities for financial institutions from providing tailored solutions, omnichannel experience and innovative avenues to communicate with customers.

Read MoreTesting of fintech products and platforms is increasingly a mix of human and automated testing thanks to advancements in technology, machine learning and artificial intelligence. The movement away from manual work can allow financial services organisations to boost product development, improve efficiencies, enhance quality and mitigate risk.

Read MoreThe Hayne Royal Commission rightfully and very publicly raised a question mark over the quality of customer data held by financial institutions. It also highlighted that data remediation – the cleansing, organisation and migrating of data – after costly and often lengthy investigation, warrants greater focus.

Read MoreData remediation activities in financial services will never cease. The best that can be achieved is significantly reducing the frequency and scope of remediations over time. This paper is a brief discussion of the triggers, execution and controls associated with data remediation events and can be applied to superannuation, wealth management, banking and insurance.

Read MoreMany data remediation programs are only started after an issue being brought to light by a customer or group of customers: often upon investigation, this gives rise to a slew of other issues that may have been impacting thousands of customers across several years.

Read MoreTom Seel is the product lead at QMV and has been involved with Investigate since its inception. He is passionate about data and data-centric projects having been involved in numerous data migration and data remediation projects throughout the superannuation industry.

Read MoreQMV is extremely honored to have our data quality technology, Investigate named as a finalist for Compliance Innovator of the Year at the 2019 Fintech Business Awards. The nomination is very timely given the findings of the royal commission and the appetite for raising benchmarks across the industry.

Read MoreThe Hayne Royal Commission’s superannuation related recommendations are first and foremost focused on promoting changes to the ways in which superannuation trustees deal with conflicts of interest and raising the standard of care which trustees adopt in managing members retirement savings. It is unsurprising that these two themes are often considered to fuse together in the form a fiduciary's best interest duty.

Read MoreWhile the Royal Commission spotlight has focused heavily on the major banks, the non-bank owned mass of the superannuation industry must also adjust to the climate of change with a resolve for improvement.

Read MoreQMV recently hosted a panel of insurance and superannuation leaders to discuss the path forward post the royal commission. The purpose of the event was to share initiatives and ideas that will drive an industry-wide transformation around people, process and technology.

Read MoreThe Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry has thrown some light onto the superannuation sector’s conduct while left alone in the dark with the retirement savings of Australians.

Read MoreThe risks of managing other people's money have been laid bare over the course of the ongoing Royal Commission into Misconduct in the Banking, Superannuation and Financial Services. Taking a closer look at the internal control environment is a sensible place to start rebuilding trust.

Read MoreThe phrase “Offence sells tickets, but defence wins championships” has been used by many great coaches across the sporting landscape. In recent times, this concept has spread from the sporting field into the white-collar world.

Read More